Finance Corner: GCASH

I have been a supporter of GCASH for the longest time. It was so far ago in fact that back then they didn't even require KYC not until it was mandated by the government. It's highly suggested to do it too to maximize all of the benefits. Just make sure that you only transact on the app and not on the bogus Messenger accounts that requests for your details.

More than another payment app, GCASH has evolved so much that it has become an excellent all around finance app I reckon this could be an effective all around tool to teach the common Filipino some finance literacy with no need for too many requirements nor ever leaving your home. Without further ado here are the features of GCASH that make it to my highly recommended list.

Login and Security

While banks are not new to the country, apps are. I am not naming banks but there are still a handful commercial banks that do not even have the basic features of login GCASH have. It auto refreshes the app after some days to revalidate the login on your phone. Most transactions require OTP accompanied by confirmation via app and text. What I would like to have in the future though is fingerprint and facial recognition to get away from inputting a pin every time we login.

Bill Payments

Most of the bills I need to pay are already in the app. There's for government (Philhealth, PAGIBIG, BIR) and essential utilities (MERALCO, water, phone). If you're a GLOBE user too, it interacts seamless with their GLOBEONE app (this is a recent feature as of writing) where the payment posting is almost instantaneous. You can pay via the GCASH app or even from the GLOBEONE app. You can save accounts too so you don't have to input the numbers every time. My only irk is with MERALCO but that is because of their weird 16 number long reference that changes every month which is it's fault if anything.

Purchases

There are three ways I use GCASH in purchasing goods:

1. Physically scanning a QR code. While not all shops are available, there are some good ones that do accept them. There's Bonchon, Jamaican Patty, Watson's, SM Department stores, Savemore (few branches for now), Potato Corner, Robinson's Department Store and Supermarket Stores, Rustan's to name a few. Even before COVID I have been on a hunt for GCASH enabled shops that I rarely have to bring cash on me anymore. No need to worry about cents anymore!

2. AMEX comes with GCASH so any online store that accepts it is fine. I was able to use it as payment for our supposed Huis Ten Bosch trip. When it was cancelled the refund was quickly processed.

3. Paypal is also another good option when you're too scared to attach credit cards but wish to use the platform for paying online goods.

GCASH is another form of payment for Lazada users too since you can connect it as well. I don't know why I don't trust Lazada for my GCASH details, but I kept on removing it whenever it got saved. I was actually reprimanded that this action would entail problems in the future so might as well not pay for GCASH there in perpetuity. (don't be like me in short).

Bank / Money Transfer

This has been the sole reason why I have not stepped foot on a bank for the longest time even pre COVID. I only now to go to the bank to pay for my taxes, and for the insurance of my amortization. Sure you can pay for taxes on the app but I really like my physically stamped tax forms. It's more on me than the app really. The things I liked are the transfer is instantaneous, it covers most banks and most of all FREE. It's a huge deal with me because I don't need to withdraw money and line up to different banks every payroll just to move money around.

Not only that, it's easy to transfer people money! You just need their phone number and you can transfer to anyone. I like that they even show you the name of the recipient so that you can at least verify who you are sending money to.

For bank transfers in between individuals, there are actually so many ways:

1. You can direct transfer to anyone

2. You can transfer by sending Ang Pao (like as a gift, minimum of 2 recipients, 1 peso minimum)

3. Or as KKB! Imagine this. You and your friends are at Starbucks and you paid for everyone's drinks via GCASH since you're the only one on the line and they're saving your favorite spot. Through KKB you can request EACH of them to pay individually for what they ordered. They will then receive the request and pay back via app with the exact amounts. Neat!

If that is not enough to convince you for GCASH, here are a few more. See, I suck when it comes to numbers, but I am all up for financial literacy. Here are more nice to have features that is quite useful ESPECIALLY for anyone who wants to start learning:

GSAVE

If you have no banks at all, you most likely won't save because money is always accessible on your pocket. This is true with most Pinoys especially in rural areas. But don't fret, GCASH has you covered. In collaboration with CIMB, it offers a higher interest in as much as 4% for 100k and up principal savings. You can even set a reminder so you can put in money every payroll! Now isn't that good? You don't need to pass so many requirements, your money is safe and best of all it earns relatively better than your traditional bank.

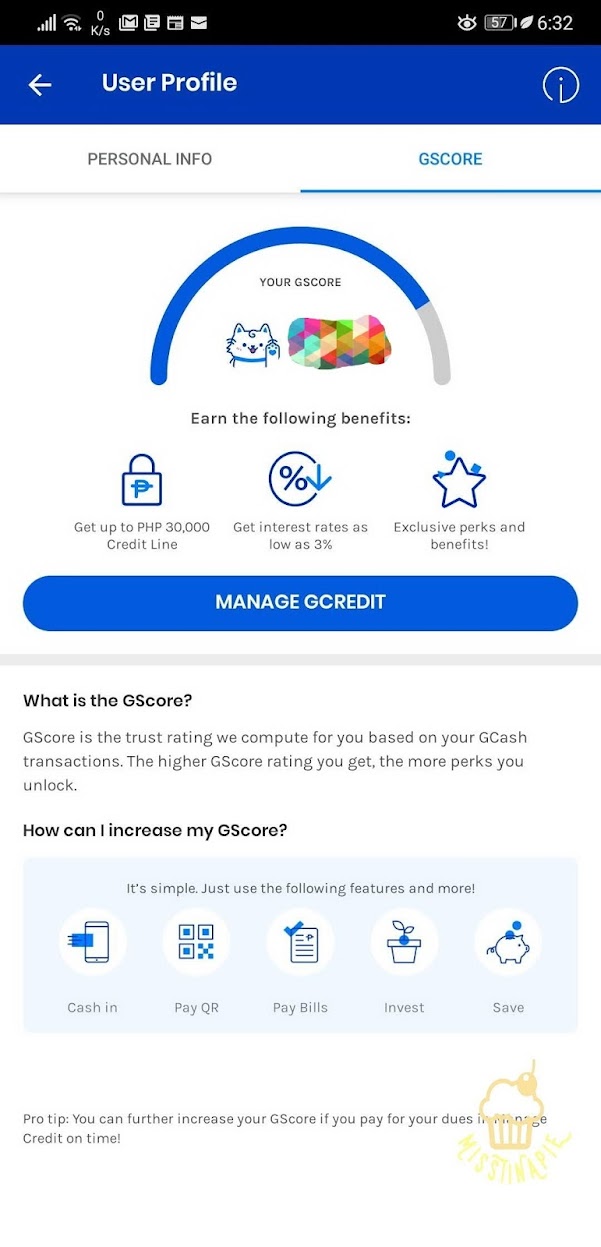

GCREDIT (and credit score while we are at it)

Back when the transaction limit with GCASH was 100k (don't worry they've increased it drastically to 500k now for as long as you have a saved bank), it came to a point when I could not fund my account with any money. I can't reload it with my bank nor at the self service kiosk. My account does have some money but I could not really do anything anymore, even pay! I was able to use GCREDIT (I discovered this in horror as I was in line to pay) and worked perfectly fine. I have read though in some reports that there are merchants that refuse to accept GCREDIT but in those times no one refused me yet.

One of the things that is not good when it comes to Pinoys is their inability to pay off debts (sadly). To be exposed to "penalties" and "fees" can deter some but I bet there are more people who through this can learn how credit works even at the smallest fees (5% monthly). I have joined a GCASH group some months ago and one of the things that make me smile are the people who on the comments are responsible borrowers who knows when they should pay what they loaned for and who are eager in having a nice credit score. Yes, GCASH actually has a credit score. It tracks your transaction records and rewards you by giving a higher loanable amount and a small surprise that you won't see on the app. You can actually show your credit score to apply for a postpaid phone from GLOBE. Becoming a trustworthy adult does have perks!

GINVEST

Most Pinoys are not as knowledgeable in investing unless you're talking of the scammy ones. This is bad because it discourages the population to reliable investment vehicles that can grow their well earned money. GINVEST is an easy gateway to build your portfolio. It's trustworthy too, being that it's managed by ATRAM which has a great track record with Mutual Funds. The fund they currently offer is Peso Money Market Fund which is as low risk as possible. What's also great is the minimum fund is just 50 PHP! It's something that mostly everyone can afford. You can also set a reminder on the frequency of your investing. Like GSAVE, GINVEST is a good habit to have every time you get your hands on some money. Start small, maybe 100 if you are really strapped. By the end of the year you would see it compounded and maybe encouraging enough to increase your funds each month. It's not too late to setup a portfolio. Remember, today is the best day to start!

GCASHINSURE

While this is not easy to find, they actually offer insurance for as low as 39 PHP (underwritten by AXA)! Obviously this is just term insurance (don't expect to get a payoff/return when you're in your 60s) but this is for your peace of mind when something inevitable happens. As self employed I got one (even if I already gotten a BDO Life insurance a few months back) since it's cheap enough to subscribe to. I like having backup of backups to be honest. I may not be a bread winner (I don't feel like one at all to be honest) but I felt like it's something I'm crazy not to have. You don't even have to worry in paying for it since it auto deducts on your account every month, with a reminder before the day so you can prepare for the amount on your account. Here are more details regarding this.

GFOREST

While it does trick you onto having more app transactions, it's something unnecessary but nice to have. You earn points whenever you do something and when you reach a certain amount you can purchase a tree which will be planted on your behalf. I don't know if there's any way to verify but hopefully they can actually show us the actual trees. It's a nice cause without actually paying for anything. And while we're on the topic, these are features I would love to have in the future:

Donations - Essentially you can donate via the bills option but I hope we get a feature where it's an option to put money into that we can track. I imagine an amount that you can choose which causes it can go to for a certain percent. Could work as a go fund me hybrid too right?

More Promos - What deters other people from having GCASH is because PAYMAYA just have so many promos when it comes to cashbacks. I circumvent this by just loading my PAYMAYA with GCASH and pay from there if I have to. They used to have those tiny promos in the form of vouchers months back but it's all gone now :-(. It's not much but I like having those, it's like I got a tiny rebate.

BEEP - Currently you can do this via BPI. But they have the worst mechanics ever. I hope they can find a way to make this more convenient instead of having unnecessary steps for an online transaction.

NFC capability - While I understand that NFC is not incorporated in cheaper phones (not mass friendly in short) I still hope that they at least give it a try for phones that can. It's a way to let go of having to scan a QR code. This could also help BEEP to be much more integrated on it's app so you don't need to have the card anymore.

Fingerprint / Facial Recognition - How about YES PLEASE.

Balance - I wish there's a way to know how much you've transacted per month There's a COINS version of this, so I hope GCASH will address this as well. I won't be able to use all 500k (I don't have that much money to move around per month anyway) but it's still a good feature to have.

Comments

Post a Comment